All Categories

Featured

The very best choice for any person should be based upon their present circumstances, tax obligation circumstance, and economic objectives. Annuity income stream. The money from an inherited annuity can be paid out as a single round figure, which becomes taxable in the year it is gotten - Annuity death benefits. The drawback to this alternative is that the revenues in the contract are distributed first, which are strained as regular earnings

If you do not have an instant need for the money from an acquired annuity, you can choose to roll it into another annuity you regulate. Via a 1035 exchange, you can guide the life insurer to move the cash money from your inherited annuity into a brand-new annuity you develop. If the acquired annuity was originally developed inside an Individual retirement account, you can trade it for a qualified annuity inside your very own IRA.

Nonetheless, it is usually best to do so asap. This will guarantee that the payments are gotten immediately which any type of issues can be handled rapidly. Annuity beneficiaries can be opposed under specific circumstances, such as disagreements over the legitimacy of the beneficiary designation or cases of excessive influence. Speak with attorneys for support

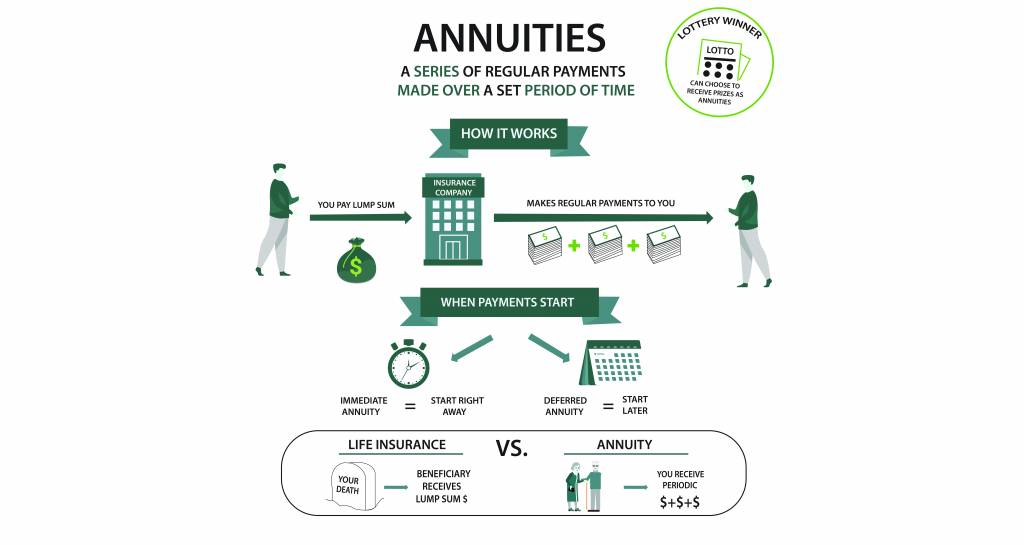

in objected to beneficiary circumstances (Annuity rates). An annuity death benefit pays out a collection quantity to your beneficiaries when you die. This is different from life insurance policy, which pays out a survivor benefit based on the stated value of your policy. With an annuity, you are essentially buying your very own life, and the survivor benefit is meant to cover any superior expenses or debts you may have. Recipients receive settlements for the term specified in the annuity agreement, which can be a fixed duration or forever. The duration for paying in an annuity differs, however it frequently falls in between 1 and ten years, depending upon contract terms and state legislations. If a recipient is incapacitated, a legal guardian or a person with power of lawyer will certainly handle and get the annuity payments on their behalf. Joint and recipient annuities are the two sorts of annuities that can avoid probate.

Latest Posts

Decoding Fixed Vs Variable Annuity Pros Cons A Comprehensive Guide to Investment Choices What Is Fixed Vs Variable Annuity Pros And Cons? Features of Smart Investment Choices Why Fixed Vs Variable Ann

Understanding Financial Strategies A Closer Look at Fixed Vs Variable Annuity Defining Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Different Retirement Plans Why Choosing the Rig

Decoding Variable Vs Fixed Annuity Key Insights on Your Financial Future What Is Variable Annuity Vs Fixed Indexed Annuity? Advantages and Disadvantages of Different Retirement Plans Why Choosing the

More

Latest Posts